Summary

- Assertio has endured an easy few years that began with its $1.5bn purchase of opioid treatment Nucynta in 2015 under its former name DepoMed.

- Nucynta was sold for $375m to a buyer last year as the company swapped opioid treatments for NSAIDs. But much of the damage had already been done.

- Assertio announced a restructuring in December last year that reduced headcount by >100, to 27. New management is inexperienced but has done a good job settling debts.

- Its product portfolio is capable of generating >$100m sales per annum. But with no sales staff, perhaps the company is looking to be bought out.

- In this article I discuss how either a buyout or a turnaround represents a triple-digit upside opportunity for risk-on investors, as the threat of bankruptcy keeps the share price artificially low.

- Looking for a helping hand in the market? Members of Haggerston BioHealth get exclusive ideas and guidance to navigate any climate.

Investment Thesis

Assertio Holdings (ASRT) stock is currently trading at a price of $1 and flirting with Nasdaq delisting laws, but was the subject of a $33 per share buyout offer as recently as 2015. The company is unrecognisable from the marketer and seller of opioid-based drugs it was then, and a lot of deadwood has been removed by the current inexperienced yet dynamic management team. Its product portfolio is now virtually opioid-free, focused on NSAIDs, and delivering sales of $93.5m in full-year 2020. Meanwhile, management has settled nearly all of the company's historical debts, disposed of all but 27 staff, and is focused on settling all outstanding litigation.

The signs may point to management now putting up the "for sale" sign, and completing a sale to a better resourced, more experienced competitor, but as I will argue in this post, there is also an argument that by switching to a digital-only sales model it could complete an unlikely turnaround, grow the share price and raise money for further acquisitions.

The other alternative - which cannot be ignored - is bankruptcy. In the rest of this post I will discuss Assertio's history as a company - including under its former name of DepoMed - cover recent developments in detail, and explain why bankruptcy, sale or success are the three scenarios investors ought to consider when weighing up the company as a potential buy opportunity.

In my view, the "sale" and "success" scenarios are more likely, and following them through to their logical conclusions, offer >100% upside in relation to Assertio's current trading price. In this game of commercialised drug portfolio poker, I believe Assertio is holding the aces, thanks to a mixture of historical accident, market appreciation, and chutzpah.

Company Overview - Transformation from Opioids To Slimmed Down NSAID Operation

Formerly known as DepoMed, in 2015 the company spent $1.05bn acquiring the rights to the opioid treatment Nucynta - an approved oral form of the opioid analgesic Tapentadol - from Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson (JNJ).

Nucynta had made sales of $166m in the 12 months to September 2014, and with patent protection until 2022/23 at the earliest, was viewed by management as a flagship asset, complementary to its existing portfolio of commercialised treatments targeting pain and CNS disorders, and potentially capable of making blockbuster (>$1bn per annum) sales. DepoMed were so bullish on future sales that management rejected a $33 per share acquisition offer from Horizon Therapeutics (HZNP).

Instead, DepoMed became embroiled in the backlash against the sale and marketing of opioid-based drugs, named in an investigation conducted by Sen. Claire McCaskil as one of a number of companies - including Mylan, Purdue, and Janssen - over payments made to advocacy groups who supported and promoted the use of opioid treatments, and the subject of widespread litigation which I will discuss later.

In 2017, with Nucynta averaging ~$250m of annual sales in the years since acquisition, and debt climbing to unsustainable levels, DepoMed sold its license to the drug to Collegium Pharmaceutical (COLL) in exchange for a $10m upfront payment, a minimum of $135m in royalties per annum for a period of four years, and a double-digit percentage royalty on net sales exceeding $235m, plus ongoing double-digit royalties after the expiration of the initial 4-year agreement.

The deal suited both parties, with Collegium believing it could revive sales of a depressed asset, and DepoMed determined to put its opioid experience behind it, which prompted the name change to Assertio in August 2018.

With its mounting debt concerns however, Assertio agreed to the sale of all of its remaining rights in Nucynta for an upfront cash sum of $375m in February this year, and also sold its anticonvulsant medication Gralise to Alvogen in a $130m deal, allowing it to pay off the remaining $162.5m of its $575m of senior secured notes issued in 2015, and repurchase $188m of the aggregate principal amount of its outstanding 2021 Notes and 2024 Notes, before issuing a tender offer to repurchase the remaining $77m outstanding.

Having disposed of all but ~$80m of its long term debt, at the expense of the majority of its revenue generating assets, Assertio agreed to merge with Zyla Life Sciences (OTCQX:ZCOR) in May last year, with each outstanding share of Zyla common stock converted into 2.5 shares of Assertio Holdings.

That gave the company control of Zyla's INDOCIN Products - suppository and oral forms of the nonsteroidal anti-inflammatory drug ("NSAID") Indomethacin, and SPRIX - a nasal spray formulation of Ketorolac Tromethamine indicated for pain relief, plus 2 non-promoted products, OXAYDO - an oral tablet form of the opioid Oxycodone - and SOLUMATRIX - consisting of ZORVOLEX (diclofenac) and NSAID VIVLODEX - which appear to be being discontinued, since a statement in Assertio's 2020 10K submission refers to the cessation of a manufacturing agreement with iCeutica for SOLUMATRIX products.

After the merger, Zyla CEO Todd Smith became CEO and President of Assertio, replacing Arthur Higgins, who became non-executive Chairman. Zyla's Chief Commercial Officer Mark Strobeck became Assertio's new CCO. The new leadership team only lasted until December, however, when Assertio announced a restructuring intended to reduce the company's cost base by $45m, on top of the $40m of synergies created by the Zyla merger.

Both Smith and Strobeck resigned, with Dan Peisert - Assertio’s Chief Financial Officer - promoted to CEO and President. To complete a roller-coaster year, in December Assertio made 107 staff redundant - including all of its field sales force - leaving just 27 staff remaining.

As such, Assertio is barely recognisable from the company it was 12 months ago, let alone subsequent to its name change in 2018. The company's shares now trade at $1, and have been granted a 180-day extension to comply with Nasdaq listing regulations, which requires Assertio stock to exceed $1.00 per share for a minimum of 10 consecutive business days on or prior to June 28, 2021.

On its Q420 earnings call CEO Peisert outlined 6 strategic priorities for Assertio in 2021:

The priorities for 2021 are as follows; build a strong and committed team with a culture of teamwork, inclusion and results, delivering on our 45 million of restructuring synergies, ensuring the company generates strong operating cash flow, ensuring our debt never becomes a constraint in running the business, mitigate our legacy legal uncertainties and develop a sustainable business model that reflects a changing environment.

After all of the upheaval, Assertio shareholders may be looking forward with optimism to what the new management team can achieve in 2021 and beyond.

The company's products (including Zyla) generated sales of $126m in FY19, and $106m last year. Operating expenses in FY20 totalled $188m, resulting in a net loss of $82m, but with its cost base and debt now drastically reduced, and a shift to a new digital-only sales model, the overall picture ought to improve, even if revenues suffer slightly.

Portfolio & Market Overview

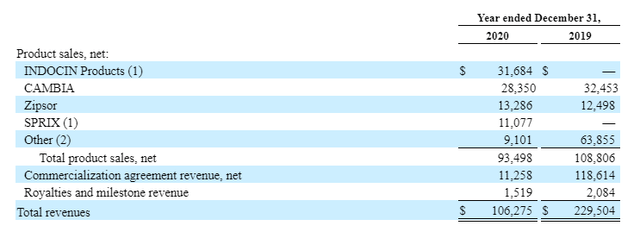

Assertio product sales past 2 years, including Zyla Life Sciences assets. Source: Assertio 10-K submission 2020.

Management will feel that the decision to discard their portfolio of opioid treatments puts them in the right market - one which is progressive, growing and supported by the regulatory authorities, rather than one which was damaging to their reputation and increasingly to their chances of becoming profitable.

Cambia - an oral solution of Diclofenac Potassium used to treat migraine attacks - and Zipsor - liquid filled capsules of diclofenac potassium for relief of mild-to-moderate pain in adults - are the only DepoMed legacy assets still marketed and sold by Assertio, making sales of $28m and $13m respectively in FY20.

Indocin is indicated for moderate to severe Rheumatoid Arthritis, Ankylosing Spondylitis, osteoarthritis, gouty arthritis and acute painful shoulder, achieving $32m of revenues in FY20, and Sprix made sales of $11m last year.

During the pandemic Assertio had to get used to operating with a severely restricted sales force, as CEO Peisert discussed on the company's Q420 earnings call:

We had 80 reps in the field or 80 territories that we had. At best we were seeing 40%, 50% of our calls made in person. So we had a very strong virtual promotion last year just because of what COVID did and COVID was also in some ways worse than what you'd expect normally because patients weren't going to go visit their physicians.

Management was not prepared to comment on their expectations for how far sales volumes might decline in FY21 with no field sales force to speak of, and says that guidance will be withheld until Q121 earnings are released, but CEO Peisert did sound an upbeat note about the prospect of reverting to digital marketing:

Building upon our experience in the past year we've begun our own first steps in this direction by continuing with telesales, telesampling and email campaigns and we've seen that Assertio products are excellent candidates to be promoted in this manner.

It's a reasonable defence of the decision to downsize operations, although it is one thing to have reduced face-to-face client contact in an environment where rivals' operations are also restricted, but an entirely different challenge to attempt to operate with no face-to-face contact in a BAU environment.

Assertio's products are quite generic in nature. Indocin, for example, is marketed under at least 12 brand names (according to Wikipedia), and targets a fiercely competitive market in which almost all major pharmaceuticals are active, and all are developing new and improved treatments.

In fairness, the Rheumatoid Arthritis market alone is valued at ~$25bn today and expected to grow to $36bn by 2026, and Assertio may think that their established sales funnels will survive so long as physicians are satisfied with the product and the price point.

But whether Assertio will be able to compete on price whilst operating a skeleton service is also questionable - the company may be planning hikes to compensate for falling sales. Will physicians be satisfied dealing with a company that lacks market experience and know-how?

Departure of Chairman and Independent Director a mixed blessing?

In this respect, the company's Board of Directors may be able to provide a helping hand, although at this point the plot thickens still further.

Arthur Higgins - a Pharmaceutical industry veteran who was Chairman of the Board of Management of Bayer HealthCare AG between 2006 and 2010, and has a net worth of $93m according to this source, and Timothy Walbert - Chairman, President and CEO of $20bn market cap commercial biotech Horizon Therapeutics (HZNP) (my October '20 note here) are listed as non-executive Chairman and Lead Independent Director respectively in an October '20 Assertio Corporate Presentation which now appears to be long out of date, and it is unclear if either is still in their position.

There is no mention of either on the company website and no mention in the 2020 10K submission, however, which suggests they may no longer be involved in the business - although Walbert's LinkedIn profile still refers to his role as ongoing. Whilst this might be a plus in some ways as both may have been well-remunerated, and their absence represents another fresh start for Assertio, the company may have benefited from their influence in terms of marketing and client/physician relationships.

Assertio's listed board members are Heather Mason, a former executive vice president (EVP) of Abbott Nutrition (ABT), James Tyree, former President of Abbott Biotech Ventures, a subsidiary of Abbott Laboratories, William T. McKee, former CFO at Barr Pharmaceuticals - acquired by Teva Pharmaceuticals - and Chairman Peter D. Staple, who according to his Assertio Bio is CEO and director of Corium International, Inc., a publicly held biopharmaceutical company, although Corium seems to have been acquired by Gurnet Point Capital in 2018.

Litigation Still Outstanding

If Assertio's sales and marketing concerns were not enough, the company is still facing a significant number of lawsuits mainly relating to the fallout from the opioid crisis.

In the "Legal Matters" section of its 10-K released last week, Assertio lists a number of claims against the company. My layman's understanding and brief summary of the cases is as follows.

- The first involves Glumetza, a diabetes drug developed by Assertio. There are several cases are being brought by former buyers of the drug, including CVS Pharmacy (CVS), Rite Aid, Walgreens (WBA), and health insurer Humana (HUM) alleging that Assertio and Bausch Health paid Lupin Pharmaceuticals - who had developed a generic version of Glumetza - to delay its entry to the market, and in exchange, promised not to compete with an authorised generic for the first twelve months that Lupin’s generic was on the market. A trial may initiate in October 2021.

- Two former members of Assertio Senior Management are being sued by shareholders in relation to misleading disclosures about the company and its business, compliance, and operational policies and practices concerning the sales and marketing of its opioid products. After initially dismissing the claims, the court has granted the parties’ joint motion to stay the appeal pending settlement discussions. Assertio comments that it believes the case is without merit, but cannot predict the outcome of the matter. There appears to be 4 more cases being brought which are also stayed pending the outcome of the appeal.

- Assertio has been subpoenaed on numerous occasions by regulatory and government authorities in relation to its marketing of Lazanda, NUCYNTA, and Gralise (a non-opioid) and continues to cooperate and respond to enquiries.

- Numerous federal and/or state statutory claims, as well as claims arising under state common law have been filed by a wide variety of plaintiffs, in relation to alleged deceptive marketing practices - Assertio intends to defend itself vigorously.

- Assertio entered into a Confidential Settlement Agreement and Mutual Release with Navigators Specialty Insurance Company and the coverage action was dismissed without prejudice.

- Finally, Patrin Pharma filed an abbreviated New Drug Application ("ANDA") seeking to market a generic version of CAMBIA prior to the expiration of patents. Assertio launched a suit against Patrin jointly with its licensor Applied Pharma Research ("APR"). Earlier this month, the Company entered into a confidential settlement agreement with Patrin.

I am not a legal expert but the above sounds like another difficult set of circumstances for the new management team to deal with, although to what extent they or Assertio have liability now that much of the previous management has departed is unclear. Legal matters are expensive to deal with and will likely place an additional strain on Assertio's already stretched financial resources.

The patent issue is also troubling. Cambia is patent protected until 2026, and Sprix and Zipsor until 2029, but that does not necessarily mean that other firms will not submit ANDA's as Patrin did, creating yet more legal expenses and a slump in sales if the ANDA's are successful.

Will Assertio Stay The Course?

Since its acquisition of Nucynta back in 2015, arguably not much has gone right for first DepoMed, and now Assertio. The company entered the opioid market at precisely the wrong time and quickly became both indebted and subject to federal enquiries and litigation in relation to its marketing practices.

The company secured a reasonable exit from Nucynta with its structured deal to sell the license to Collegium, but was ultimately forced to settle for a $375m cash payment rather than a share of ongoing royalties.

The merger with Zyla brought a portfolio making sales in the triple-digit millions to the table, but the apparent departures of most of the key players in that deal - from Zyla management, to Assertio's Chairman and possibly its Lead Independent Director also, has been followed by the laying off of its entire sales force, leaving only 27 staff at the company.

The current management team has limited experience on the marketing side, but will attempt to press ahead with a digital-only strategy, hoping that it will not severely impact sales. Having apparently done a good job settling Assertio's debts, there remains outstanding litigation to be addressed which could become a substantial drain on resources, and the company reported just $21m of cash as of Q420.

Finally, Assertio is struggling to maintain compliance with Nasdaq listing laws and has until June to exceed a minimum closing price of $1 for 10 days consecutively.

Investors who are unwilling to embrace a high level of risk (will Assertio even be a listed entity in 12 months' time?) would probably do well to steer well clear of Assertio, but for those who favour a risk-on, high-risk, high-reward investment, it's possible to argue the bull case for Assertio.

First of all the company has drastically reduced its overheads, taking the ruthless - or necessary, depending on how you look at it - decision to eliminate its sales force and retain just 27 employees. The December restructuring is expected to save $15m per annum whilst management says cost synergies of $40m have been achieved since the Zyla merger. Finally, Chief Financial Officer Paul Schwichtenberg commented on the earnings call:

because of the recent restructuring we expect in 2021 to achieve additional SG&A savings off of the annualized second half 2020 operating expense run rate including opioid legal cost. For clarity our pre-restructuring operating expense run rate including our opioid legal costs for the second half of 2020 is 43.7 million which translates into an annual operating expense run rate of approximately $87.4 million. In 2021 we expect to achieve $40 million of savings off of this run rate and ultimately $45 million in annual savings beginning in 2022.

Assertio's total costs and expenses in FY20 were $188m, which includes loss on impairment of goodwill and intangible asset charges of $17m and restructuring charges of $17.8m, plus $24.8m amortisation. If we ignore these and focus on COGS, SG&A and R&D - total $128.5m - and subtract $40m, to get $88.5m, and if we remain optimistic on FY21 sales and forecast a 15% annual drop-off - to ~$79.5m, we can see that Assertio would not be too far away from breaking even in FY21 - and litigation costs have been factored into the equation.

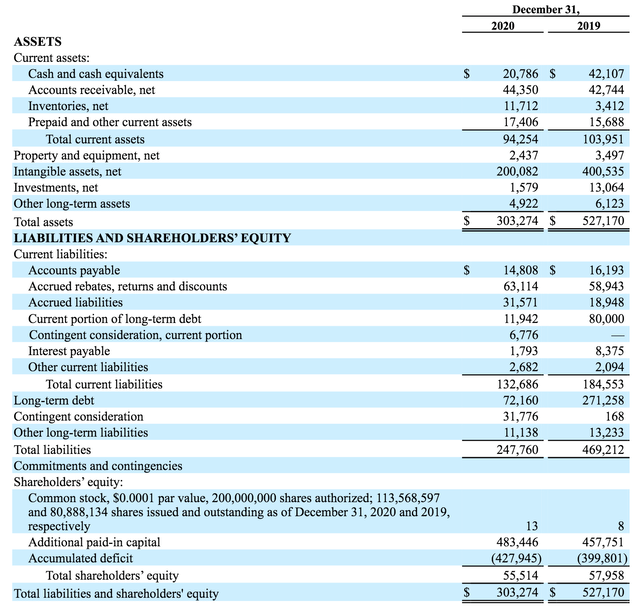

Assertio's lack of funds would remain an issue, however - the company still has ~$80m of debt to service, and $132m of near-term liabilities versus $94m of near-term assets (as shown below), but 2 recent share offerings offer some encouragement, as well as, unfortunately, further dilution.

Assertio balance sheet as of FY20. Source: company 10-K submission 2020

Assertio balance sheet as of FY20. Source: company 10-K submission 2020

On February 9th, Assertio completed a registered direct offering with certain institutional investors and accredited investors, selling 22,600,000 shares of common stock at a purchase price of $0.62 per share, raising $14m, and on February 12th, the company sold 35,000,000 shares of common stock at a purchase price of $0.98 per share, raising ~$34m.

Whether the uplift in price between the first and second offering is significant - suggesting demand for the stock was high - is open to question, but the fundraising is another example of a capable management team, in my view, that have displayed proficiency both in settling debts and raising funds. The downside is that Assertio's share count has risen to >170m.

Management has expressed an interest in making strategic additions to the existing product portfolio, stating in its offering prospectus that it may use funds to "acquire or invest in complementary businesses, products and technologies", whilst also preaching conservatism in its approach to new opportunities.

The Acquisition Option - Will Management Sell The Business?

In reality, I think it would be very difficult for Assertio to pull off any acquisitions in its current straitened condition, but management may be teasing the idea, perhaps in order to make itself an acquisition target.

That would certainly be a logical option for the current team to pursue, because although a new Chief Accounting Officer, Chief Financial Officer, Head of Investor Relations and Legal counsel have been appointed, there remains no Chief Marketing Officer. That begs the question as to how serious management is about attempting to make the current portfolio work long-term.

Having taken control of the business, overseen the departure of staff, and senior management and directors, and settled the majority of its debt, Assertio management may be about to place the "for sale" on the product portfolio and wait for prospective buyers to make them an offer.

The company's current market cap is $168m, but how much would a prospective buyer be prepared to pay? My guess is substantially more than that, when we think about a price to sales ratio of <1.5x based on Fy20 revenues, plus the fact that there are companies in the market launching ANDA's to market generic versions of e.g. Cambia. Maybe a quicker and easier path to profitability for these companies would be to complete a buyout of Assertio and gain access to the desired product, plus several more complementary assets.

3 Possible Scenarios - Bankruptcy, Sale or Success

Based on my research I think there are 3 possible endings - or new beginnings - to the Assertio story.

Let's start with the worst-case scenario. Assertio lacks the sales and marketing know-how to continue to sell its portfolio of assets and rapidly loses market share to rival companies. Its existing relationships with prescribing physicians and positions on formulary lists dissipate quickly and management are unable to make sufficient cost savings to make the business work. Assertio fails to regain compliance with the Nasdaq and eventually files for bankruptcy.

This would clearly be bad news for retail investors, who would be unlikely to recoup an investment of $1 per share, and may have to settle for less than half that figure as an asset fire sale takes place.

Now let's consider a scenario where management goes all out to try to make a success of the business. Existing sales channels are not impacted, and the product portfolio even increases sales year-on-year as pandemic pressures ease and the switch to a digital marketing approach pays off, making selling a more seamless and streamlined process. The company makes it through FY21 and breaks even, whilst the share price gains on positive Q1 and Q2 earnings, allowing management to raise further funds and target new product acquisitions. An experienced Director of Marketing is appointed to implement a long-term digital platform-based sales strategy.

Clearly, this would be very good news for investors. The market for NSAIDs is forecast to grow in size to $24.35bn by 2027, at a CAGR of 5.8%, so it is also a credible thesis, in my view. Assets such as Indocin, Sprix, Cambia et al have never failed to sell, they have simply been owned by failing businesses that have found themselves in a situation where their best option has been to pass them on. Even Zyla, under its former name Egalet, had been filing for bankruptcy owing to the failure of its tamper-resistant opioid products at the same time it was acquiring Indocin from Iroko Pharmaceuticals in 2018.

The final scenario is one in which Assertio continues to play poker whilst it waits for an acquisition bid. Management acts as though it expects to be there for the long term and continues to manage the company's debt and its litigation concerns, but also lets it be known that it will sell at e.g. $3 per share, valuing its assets at just over $500m. As with Nucynta, a buyer presents itself before Assertio has eroded its existing sales channels and a deal is completed before the end of the year.

In this scenario, again a retail investor would theoretically win, having shown faith at a difficult time for the company. The current saga would end with management being rewarded for its good stewardship during very challenging times, and a better resourced, more experienced company would take over a triple-digit-million revenue generating portfolio of assets, using its established sales and marketing channels to stimulate long-term revenue growth.

Conclusion - Management's Momentum Can Deliver The Desired Upside

3 scenarios, 2 of which are optimistic and 1 pessimistic. Arguably, the odds are stacked in favour of a positive outcome for Assertio and its shareholders, with potentially, 300% upside a possibility. Due to the state of its finances, it ought to be clear after Q1 earnings are published and FY21 guidance released which is the most likely outcome of the 3 I have highlighted above.

If sales are in freefall as of Q121, that is clearly a problem that management may find it all but impossible to reverse, and prospective acquirers may be able to name their price for the company - although I still believe they would be prepared to pay a significant premium to $1 rather than waiting for Assertio to go bankrupt and participate in an asset firesale. Paying an extra $50-80m to gain access to the portfolio 12 months earlier by completing a buyout at ~$250m would represent good business, in my view, and earn a nice premium for investors of ~50%.

Personally, I think the strength of the current portfolio tilts the balance in favour of a positive outcome. I agree with management that its NSAID portfolio could almost sell itself. The proof for this is that their sales performance across 3 different companies has always been consistent. It is doubtful that Assertio's focus in the final quarter of 2020 had been 100% on product sales given all the upheaval at the firm, and yet its products made a healthy $29.8 of sales under pandemic conditions, not BAU.

As such healthy Q1 results would rapidly push up Assertio's share price and force the hand of any would-be acquirer, in my view, who I could see paying up to $2.5 per share for a quick deal.

And if management does complete an unlikely turnaround, raise further funds - possibly using convertible debt as opposed to share issuance - to make further acquisitions, and establish a healthy, non-controversial product portfolio, that is when shareholders stand to gain the most. Stocks as cheap as Assertio's are capable of generating rapid price momentum and a good strategic acquisition of a successful pain relief product can transform a company's fortunes - remember Horizon's offer to buyout DepoMed at $33 per share?

As such - despite how things may look at Assertio now - stripped of its best-selling assets, its staff, and management, and desperately trying to stay afloat, the company is not quite the basket case the market may think, and there is a clear opportunity for risk-on investors to generate triple-digit upside in a short space of time.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.